The real challenge in blogging these days is to provide helpful commentary on what’s going on in Washington. It’s like someone – I wonder who? – placed all parts of the major issues in a cannon and blasted them into the sky. Are we moving toward war with North Korea? Will the insurance markets collapse as President Trump undermines Obamacare? Will the North American Free Trade Agreement (NAFTA) dissolve? Will the Iran nuclear agreement unravel as Trump tries to weaken it? The pieces will continue to fall over the coming months and no one can be sure how or where they will land.

One thing is for sure; Trump’s first priority seems to be pleasing his base. One recent poll found that a majority of Republicans favor a preemptive strike against North Korea. Don’t they realize there are thousands of artillery pieces and rocket launchers pointing south along the 38th parallel? Massive destructive forces are within easy range of Seoul, South Korea with its population of almost 10 million people. Even if Kim Jung-un is unable to launch a nuclear tipped rocket the carnage that would follow this U.S. act of war is unthinkable.

No doubt many of Trump’s supporters hate the Affordable Care Act (Obamacare), if for no other reason than its name. But research by the Associated Press shows that 70 percent of those who benefit from insurance discounts on deductibles and co-pays that the federal government subsidizes are in states that helped elect Trump. Of the top 10 states that benefit the most, nine voted for Trump. No matter, Trump carelessly refuses to fund the subsidies.

These folks will continue to receive this support because insurers are required by law to provide it. But without the offset of federal payments the companies that don’t exit the markets will be forced to raise premiums for other insureds, potentially making coverage for them too expensive. Trump has punted this thorny problem to Congress, perhaps to spitefully punish congressional Republicans for failing to repeal and replace Obamacare. .

NAFTA is considered to be a bad deal by many workers in the rust belt who voted for Trump. But if you talk with farmers in the heartland where Trump scored big with the voters you might hear a different story. Farming economies depend on exports and American farmers are among the most efficient in the world. Reports indicate that many Mexican corn farmers were put out of business by NAFTA.

Plus NAFTA has helped the U.S. manufacturing sector be more competitive with Asian and European competitors. Actually it is surprising that more free-trade Republicans haven’t pushed back on Trump’s initiatives to renegotiate trade agreements and his rejection of the Trans Pacific Partnership. Perhaps they prefer to avoid his wrath.

We can’t speculate on how Trump’s action to decertify the Iran nuclear deal will play out. Like his decision on Obamacare subsidies, Trump has tossed the contentious Iran issue into the hands of the Republican-controlled Congress. Congress must now decide if sanctions are to be imposed.

Secretary of State Rex Tillerson was left to clean up some of Trump’s mess. On CNN’s “State of the Union” on Sunday he was asked if he agrees with Defense Secretary James Mattis’ who prefers that Congress not immediately impose sanctions on Iran. Tillerson said “I do agree with that, and I think the president does as well.” I am no fan of Tillerson, but if he and Mattis resign or are fired the country will be in much deeper trouble.

With less than 28 legislative days left in 2017, however, Congress already has more than it can handle. I seriously doubt if it will take any action to renew sanctions on Iran. The big question concerns the payment of Obamacare insurance subsidies. With so many Republican voters likely to be damaged by Trump’s refusal to pay subsidies, will Congress intervene? Who knows?

Meanwhile congressional Republicans are desperate to pass some type of tax cut. They believe their control of Congress depends on it. Senate Republicans are to vote this week on a budget resolution designed to facilitate passage of tax legislation without Democratic votes. They have scuttled a rule that would delay voting on a bill until 28 hours after its official budget impact has been completed. In other words, don’t worry about how the tax bill affects the budget, just get it done.

In order to speed the progress on tax legislation, the deficit-hawkish House Freedom Caucus is no longer demanding the $200 billion in mandatory spending cuts that were included in the House budget resolution. Consequently it seems likely that the final budget resolution to be voted on by both the House and the Senate will simply authorize a tax plan that could add $1.5 trillion to the deficits over the next decade. Still, there is no assurance that both chambers will get it done.

I don’t believe that there has been a time during my adult life when the country has been so adrift and rudderless. Trump is not a leader; he is a divider and destroyer — a wrecking ball without morals, conscience or integrity. I see him as the modern day equivalent of Nero who fiddled while Rome burned — except it is the credibility, the values and the ethics of the United State of America that are being destroyed — while he plays golf.

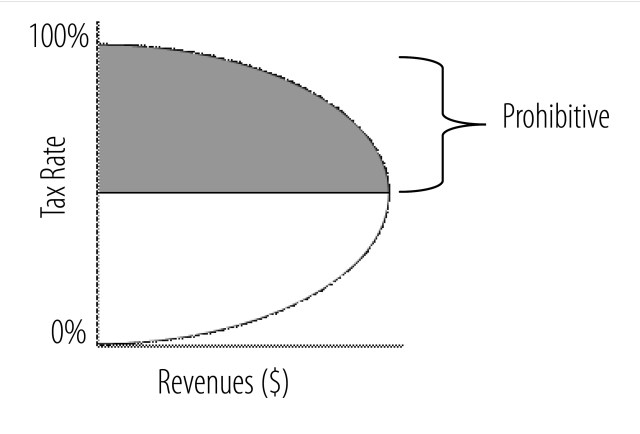

Laffer’s purpose was to show that as the top tax rate goes up it initially increases revenue but at the tip of the curve economic growth is stifled and revenues begin to go down. At a 100 percent tax rate no revenue would be collected because there would be no incentive to work. This is obviously false since the top tax rate during 1952 and 1953 was 92 percent and lots of people were still working and paying taxes, even the very rich who were subject to that rate.

Laffer’s purpose was to show that as the top tax rate goes up it initially increases revenue but at the tip of the curve economic growth is stifled and revenues begin to go down. At a 100 percent tax rate no revenue would be collected because there would be no incentive to work. This is obviously false since the top tax rate during 1952 and 1953 was 92 percent and lots of people were still working and paying taxes, even the very rich who were subject to that rate.